'Significant growth' in the Town of the Blue Mountains (TBM) could help keep taxes down while increasing the cash available for the town to spend in 2021.

TBM will be finalizing its 2021 budget in early February, which currently proposes a 1.3 per cent tax rate increase.

“The actual tax levy is increasing by 5.2 per cent. However, because we've seen significant growth, we are going to receive an extra $635,988 in tax revenue. So, the end result is that there's a 1.3 per cent tax rate increase,” stated Ruth Prince, director of finance and IT for TBM. “The town has been in a very fortunate position.”

The proposed budget outlines an average residential property tax bill of $5,466 based on an assessment of $620,000.

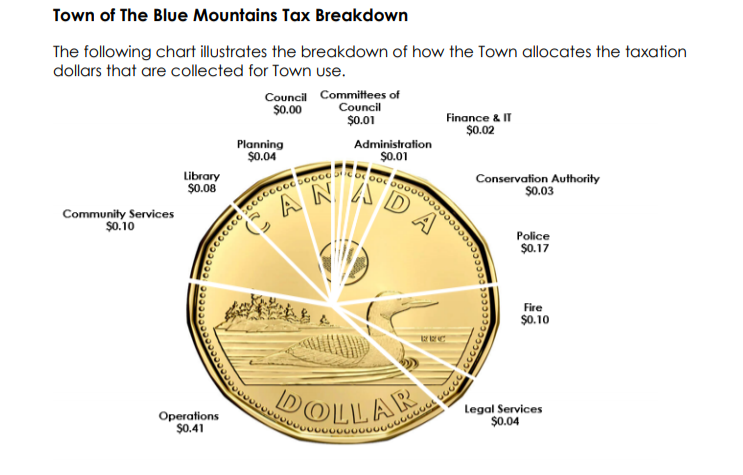

Of the $5,466, 17.4 per cent or $949 would be filtered to the education tax; 41.3 per cent or $2,256 is allocated to Grey County and $2,256 or 41.4 per cent remains in TBM.

Assessments for 2021 have been frozen at the 2020 assessment rate level in response to the COVID-19 pandemic.

“So, what does that mean for an average town tax bill? If your assessment is that $620,000, you may see the town portion increased [from 2020] by $31,” Prince said.

In the proposed budget, the town’s capital budget totals $23.6 million with 13 per cent of the funding coming from development charges and the remaining funds being drawn from long-term debt, property owners and reserves.

Capital projects outlined for 2021 include the Camperdown Wastewater Extension, upgrades to Jozo Weider Boulevard, replacement of two bridges, as well as replacing an aerial pumper in the fire department's fleet.

“We are being prudent, but we are trying to do a lot,” stated TBM Mayor, Alar Soever.

TBM has outlined four studies that are expected to be completed in 2021 – the town’s density/intensification study, the Leisure Activity Plan, a compensation review and the Fire Master Plan.

Town staff and council have also suggested additions to the base budget, including several new staff positions: an administrative assistant to committees; a communications assistant; a communications coordinator; a fire prevention inspector; an additional landfill operator; a contract building inspector; permit and inspection assistant; lot development technologist; and a development reviewer.

In addition, TBM has outlined plans to pursue the creation of a dog park in Craigleith, installation of EV charging stations, adding a parks vehicle to its fleet and has also diverted funds into the communications department for additional advertising.

The base budget additions total $917,550, with $496,680 being drawn from taxation.

Four departments in TBM – water, wastewater, harbour and building departments – are funded through user fees, not taxation.

“In terms of water and wastewater rates, there is no change to the water consumption, but there is a two per cent proposed increase to the wastewater consumption charge, and that would see an increase of approximately $6 a year,” Prince said.

The draft budget also proposes several changes to the fee structure at the Thornbury Harbour, including a $2-per-foot increase to the Seasonal Mooring fees.

Town staff have been actively working on the draft budget since June and TBM council held budget deliberation meetings on Dec. 2, 7 and 9, as well as a public meeting on Jan. 11.

Comments received at the public meeting included concerns around the Camperdown Wastewater Extension project, affordability for seniors on a fixed income, and housing concerns.

“Young families are effectively being precluded from living in the area as they simply cannot afford to live here. Home prices [are] rising at an alarming rate and [there is] alack of housing inventory available,” stated Katie Bell, in a letter to council.

“The town deferred 2020 tax bill payment by one month in an effort to help residents meet the payment indicating the council acknowledges the difficult economic environment. Now, instead of continued support to the constituents, council will introduce a tax hike,” Bell continued.

The Blue Mountain Ratepayers Association (BMRA), which has its own budget review committee, performed an analysis of the TBM draft budget and presented a deputation to TBM council on Dec. 8.

In its deputation to council, the BMRA applauded the town for their continued efforts in remaining fiscally responsible while addressing the needs of the community through the COVID-19 pandemic.

However, the group drew some concerns around the town’s ability to complete capital projects in a timely manner.

“Depreciation is greater than new capital builds and has been for some time,” stated Brian Harkness, chair of BMRA's budget review committee in the deputation to council.

The BMRA is also continuing its efforts in trying to find justification in the large percentage of tax dollars that is allocated to the county, in comparison to other lower-tier municipalities in the region.

“BMRA is concerned about the increasing amount of municipal tax assessment dollars directed to the county and not available for the town to spend on needed capital projects, such as a modern community centre,” Harkness continued.

Currently, 41.3 per cent of the tax dollars collected from TBM residents is allocated to Grey County.

In 2020, the average TBM resident paid $2,268 in tax dollars to Grey County, which is the highest paid by any resident of all nine Grey County municipalities.

The Municipality of Grey Highlands held the second-highest contribution rate in 2020, contributing, on average, $1,483 per resident.

Comments from the public meeting will be presented to council in a staff report on Jan. 26, where council members will take one final look at the proposed draft budget.

“We're now at 1.37 [per cent increase], but we're going to be meeting to fine tune things once a public meeting where everybody will have a chance to provide some more comments,” Soever said, adding that council members hope to reduce expenditures further to reach a zero per cent tax increase.

The budget bylaw will appear before council for final approval on Feb. 8.