The average home in The Blue Mountains is paying significantly more in taxes to Grey County than similar homes in every other local municipality.

At its meeting on Oct. 11, The Blue Mountains council received an updated staff report that broke down taxes paid by jurisdiction based on average assessments and income levels.

This was the second report on the matter, after council requested additional information upon receiving the initial staff report on the subject on Sept. 27.

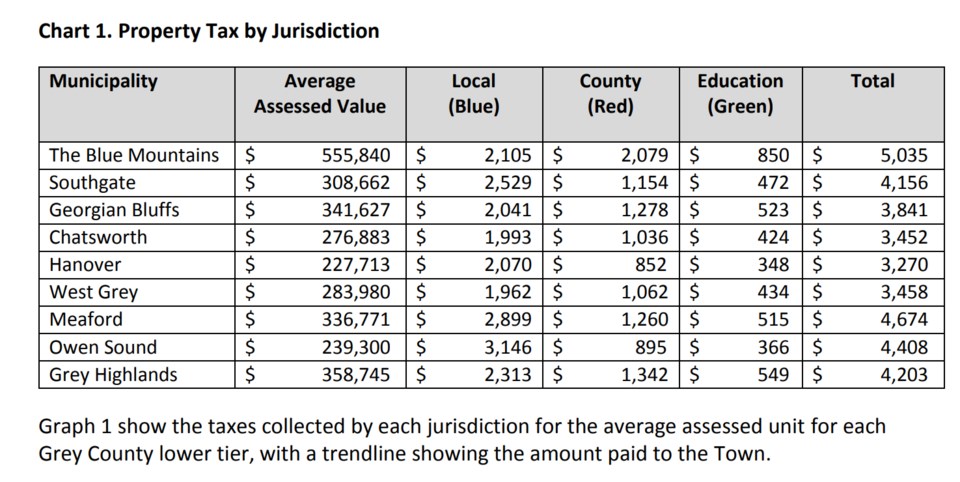

Grey County's tax rates are the same across the board, but they are based on assessed value of a home. Charts in the report show a significant disparity between the assessed values and, therefore, the dollar value of taxes paid by homes around the county.

In The Blue Mountains, the average home is assessed at $555,840, which translates into $2,079 paid annually to Grey County. In comparison, the next highest municipality is Grey Highlands with an average assessed home of $358,745, which translates into $1,342 in county taxes. The home in The Blue Mountains pays 55 per cent more in county taxes than the home in Grey Highlands.

“We’re stuck in a bind. We work hard to keep our taxes low,” said The Blue Mountains Mayor Alar Soever. “We can’t afford to tax at the local level because of what we pay at the other levels.”

The total tax bill for an average assessed home in The Blue Mountains is now $5,035 ($2,105 for local municipal taxes, $2,079 for Grey County taxes and $850 for school board taxes).

The information in the report illustrates the major difference in property values and county taxes paid between The Blue Mountains and every other municipality in Grey County.

In the other eight municipalities, average assessments range from $358,745 at the high end in Grey Highlands and $227,713 at the low end in Hanover. Those values translate to $1,342 in county taxes being paid in Grey Highlands and $852 in Hanover.

Soever says he often hears representatives from outside The Blue Mountains say that homeowners in The Blue Mountains are wealthy (based on assessment values) and shouldn’t complain about shouldering a larger tax burden.

“It reflects that the average home in The Blue Mountains is assessed quite a bit higher. What’s relevant is: what is the burden?” said Soever. “(Local homeowners) have a home that is becoming more valuable, but that is where they live and those funds aren’t accessible.”

Council received the report for information, with only Soever offering extensive comments on the matter.